BTC Price Prediction: Will Bitcoin Hit $200,000 Amid Current Market Dynamics?

#BTC

- Technical Strength: Bitcoin price remains above key moving averages with bullish momentum indicators

- Market Sentiment: Positive news flow around institutional adoption and regulatory progress

- Capital Requirements: Significant additional investment needed to sustain rally to $200k

BTC Price Prediction

BTC Technical Analysis: Bullish Indicators Signal Potential Upside

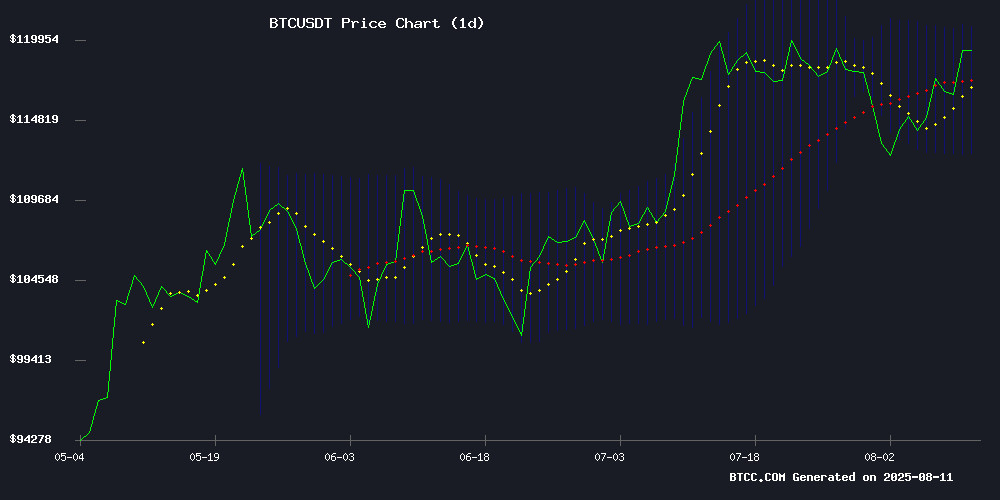

According to BTCC financial analyst William, Bitcoin's current price of $121,253.95 sits comfortably above its 20-day moving average of $116,852.57, indicating a strong bullish trend. The MACD histogram shows positive momentum at 198.52, while the price hovers NEAR the upper Bollinger Band at $121,260.09. These technical indicators suggest continued upward potential in the near term.

Market Sentiment: Positive Catalysts Fuel Bitcoin Optimism

BTCC's William notes that recent news highlights several bullish factors for Bitcoin: Michael Saylor's massive $74B bet, El Salvador's regulatory progress, and the 95% mined supply milestone. However, analysts warn that significant capital inflows are needed to sustain the rally and reach gold's market cap levels. The surge in 'wrench attacks' also presents a growing security concern for holders.

Factors Influencing BTC's Price

Why Michael Saylor Trending On X? What’s Behind $74B Bitcoin Bet?

Michael Saylor's unwavering advocacy for Bitcoin continues to dominate financial discourse, with his $74 billion bet on the cryptocurrency drawing intense scrutiny. The MicroStrategy co-founder's conviction that Bitcoin represents the future of institutional asset allocation has sparked fervent debate across social platforms.

Market observers note Saylor's influence extends beyond mere price speculation. His public framing of Bitcoin as a macroeconomic hedge against fiat currency debasement resonates with both retail and institutional investors. The scale of MicroStrategy's BTC holdings now rivals many sovereign wealth funds' gold reserves.

Bitcoin's 95% Mined Supply Could Signal End Of Traditional Four-Year Cycles

Bitcoin's market dynamics are undergoing a seismic shift as institutional adoption reaches unprecedented levels. The top 100 corporate treasuries now hold nearly one million BTC, challenging long-held assumptions about the cryptocurrency's four-year cycle. With 95% of the supply already mined, the trading float increasingly depends on institutional buying rather than halving events.

Market observers are sharply divided. Jason Williams, author and investor, declares the four-year cycle dead, pointing to corporate accumulation as the new price-setting mechanism. Bitwise's Matthew Hougan agrees in principle, though cautions the pattern won't be officially broken until 2026 returns confirm the thesis. The traditional model, which predicted peaks in 2013, 2017, and 2021 following halvings, now faces its greatest test.

What emerges is a market at an inflection point. The same scarcity mechanics that once drove retail speculation now fuel institutional accumulation, potentially rewriting Bitcoin's playbook entirely. As Hougan notes, the proof will come not in theories but in price action - and whether 2025 delivers the expected halving rally or something entirely new.

4 US Economic Indicators to Watch This Week As Bitcoin Reclaims $122,000

Bitcoin's price action is increasingly tied to macroeconomic signals as institutional adoption grows. This week's US economic data releases could prove pivotal for crypto markets.

The Consumer Price Index (CPI) report on Tuesday stands as the most consequential event. Economists forecast a 2.8% year-over-year inflation reading for July, up from June's 2.7%. Goldman Sachs echoes this projection, with tariff implementations likely contributing to price pressures.

A hotter-than-expected CPI print could strengthen the dollar and pressure Bitcoin's price downward. Conversely, softer inflation data might ignite a crypto rally. Market participants await the Labor Department's release with particular attention given recent employment figures.

Bitcoin Volatility: Key Market Movers This Week

Crypto and equity markets extend their rally amidst lingering tariff uncertainties, buoyed by softening economic indicators and heightened expectations of a September rate cut. Analysts caution that trade tensions, macroeconomic shifts, and geopolitical risks could reintroduce volatility.

Inflation data takes center stage this week, with July's Core CPI reading anticipated to edge up to 2.8%. The PPI report and retail sales figures will further illuminate pricing pressures and consumer resilience. These metrics collectively shape Fed policy expectations moving into the fall.

Willy Woo Calls Bitcoin 'Perfect Asset' but Stresses Need for Greater Capital Inflows

Bitcoin analyst Willy Woo has proclaimed bitcoin the "perfect asset" for the next millennium, though he emphasized that it must attract significantly larger capital flows to rival gold and the US dollar. Speaking at the Baltic Honeybadger conference in Riga, Woo highlighted Bitcoin's potential but underscored its current limitations. With a market cap of $2.43 trillion, Bitcoin remains a fraction of gold's $23 trillion and the US dollar's $21.9 trillion money supply.

Woo also raised concerns about corporate Bitcoin treasuries, warning of opaque debt structures and potential vulnerabilities. "The weak ones will blow up, and people can lose a lot of money," he cautioned. He questioned how these treasuries WOULD fare in a bear market, pondering which entities might be exposed and how much Bitcoin could flood back into the market.

Another risk WOO identified is the growing preference among institutional investors for spot Bitcoin ETFs and large custody platforms over self-custody. This trend, he argued, could centralize Bitcoin holdings, potentially undermining its decentralized ethos.

BTC Price Surges to $121K Amid El Salvador's Regulatory Momentum

Bitcoin's price soared to $121,823, marking a 2.8% gain in 24 hours as El Salvador's progressive banking law fuels institutional confidence. The landmark legislation enables regulated banks to integrate digital assets, requiring $50 million minimum capital and stringent licensing. This framework has unlocked crypto investment avenues for high-net-worth clients, creating measurable market impact.

The rally coincides with bullish BTC price prediction models gaining traction. El Salvador's strategic regulatory approach positions Bitcoin at the inflection point of mainstream finance, with banking sector adoption driving unprecedented price momentum.

Bitcoin Requires Massive Capital Inflows to Rival Gold's $21.9 Trillion Market, Analyst Warns

Bitcoin's $2.42 trillion market capitalization pales in comparison to gold's $23 trillion valuation, underscoring the monumental capital inflows needed for the cryptocurrency to emerge as a genuine competitor in the global monetary system. The digital asset currently represents less than 11% of gold's total market value.

Corporate adoption of Bitcoin through treasury strategies carries hidden risks, particularly around undisclosed debt structures. "No one's really publicly looked deeply into the debt structuring," noted analyst Willy Woo, warning that weaker positions could collapse during market corrections. The sustainability of these corporate holdings faces particular scrutiny during bear markets, with concerns about Leveraged positions unwinding and coins flooding back into the market.

Heavy reliance on exchange-traded funds and institutional custody solutions presents another challenge, potentially concentrating Bitcoin holdings within easy reach of government regulators. This centralization risk runs counter to Bitcoin's original decentralized ethos.

Current market dynamics show Bitcoin trading at $12,000, with altcoin treasury strategies now mirroring Bitcoin approaches - potentially setting the stage for another speculative bubble. The intersection of institutional adoption and hidden financial engineering raises questions about the cryptocurrency's path to mainstream acceptance as a store of value.

Kidnappings of Bitcoin Holders Surge Amid Data Leaks

Alena Vranova, founder of SatoshiLabs, has issued a stark warning about the rising tide of wrench attacks and kidnappings targeting Bitcoin holders globally. Speaking at the Baltic Honeybadger 2025 conference in Riga, she revealed these violent crimes—aimed at extracting private keys—now occur weekly. Victims range from high-net-worth individuals to those holding modest sums, with cases involving as little as $6,000 in crypto.

The surge correlates with massive data leaks from centralized exchanges like Coinbase, where breaches have exposed over 80 million user identities—including 2.2 million home addresses. Vranova notes a disturbing pattern: these attacks escalate during bull markets, suggesting criminals are emboldened by rising Bitcoin valuations.

Bitcoin Exec Warns of Surge in Violent 'Wrench Attacks' Targeting Crypto Holders in 2025

Alena Vranova, founder of SatoshiLabs, has issued a stark warning about the alarming rise in violent crimes targeting cryptocurrency holders. Known as "wrench attacks," these incidents involve kidnappings, physical assaults, and extortion aimed at coercing victims into surrendering their private keys. Vranova revealed that at least one Bitcoiner is victimized globally each week, with cases ranging from kidnappings over $6,000 in crypto to murders for $50,000.

Industry data from Chainalysis suggests 2025 could become the most dangerous year on record, with wrench attacks nearly matching historical highs. If current trends persist, incidents may double by year-end. The surge is partly attributed to massive data leaks from centralized services, exposing over 80 million crypto user identities—2.2 million of which include home addresses.

Most breaches originate from KYC-compliant exchanges and wallet providers, creating a goldmine for criminals. The targeting of mid-tier holders debunks the myth that only wealthy "Bitcoin OGs" are at risk.

Understanding Bid-Ask Spread and Slippage in Cryptocurrency Markets

Cryptocurrency trading involves more than just buying and selling at desired prices. The bid-ask spread—the gap between the highest price a buyer is willing to pay (bid) and the lowest price a seller will accept (ask)—plays a critical role. Market dynamics like supply, demand, trading volume, and liquidity dictate these prices. High-liquidity assets such as $BTC often attract arbitrage traders who exploit price discrepancies across exchanges or capitalize on the bid-ask spread itself.

Liquidity varies widely across markets. Forex, for instance, is far less manipulable than crypto. Within digital assets, Bitcoin's DEEP liquidity makes it a prime target for arbitrage strategies. Traders employ market orders for instant execution or limit orders to set specific prices, each choice carrying distinct trade-offs.

Trump-Appointed Crypto Council Head Bo Hines Steps Down

Bo Hines, the head of the TRUMP administration's White House Crypto Council since December 2024, is resigning to return to the private sector. During his tenure, Hines spearheaded key policy initiatives, including the push for dedicated cryptocurrency regulations and the passage of the GENIUS Act, which established a framework for dollar-pegged stablecoins.

Hines, a former college football player, was appointed by President Donald Trump to lead the newly formed council following an executive order aimed at overhauling U.S. digital asset policy. His efforts included directing the release of a comprehensive regulatory roadmap and implementing Trump's executive order to create a Bitcoin strategic reserve. The reserve's growth, however, has been constrained by budget-neutral acquisition methods, limiting BTC additions to asset seizures or other cost-free channels.

In March, Hines proposed revaluing U.S. Gold holdings to fund bitcoin purchases without impacting the federal budget. He also engaged with over 150 industry representatives in his first three months. Patrick Witt will succeed Hines, who will remain as a special government employee to assist with AI initiatives alongside AI and Crypto Czar David Sacks.

Will BTC Price Hit 200000?

BTCC analyst William suggests that while current technicals and sentiment are bullish, reaching $200,000 would require sustained capital inflows and continued positive developments. Key factors to watch include:

| Factor | Current Status | Impact |

|---|---|---|

| Technical Indicators | Bullish (Above MA, Positive MACD) | Positive |

| Market Sentiment | Optimistic (Institutional Interest) | Positive |

| Capital Inflows | Needs to Increase Significantly | Potential Limitation |

| Regulatory Environment | Improving (El Salvador) | Positive |

While $200,000 is possible in this cycle, it would require the current bullish trends to continue and accelerate, particularly in terms of institutional adoption and capital inflows.